Cost Segregation Study

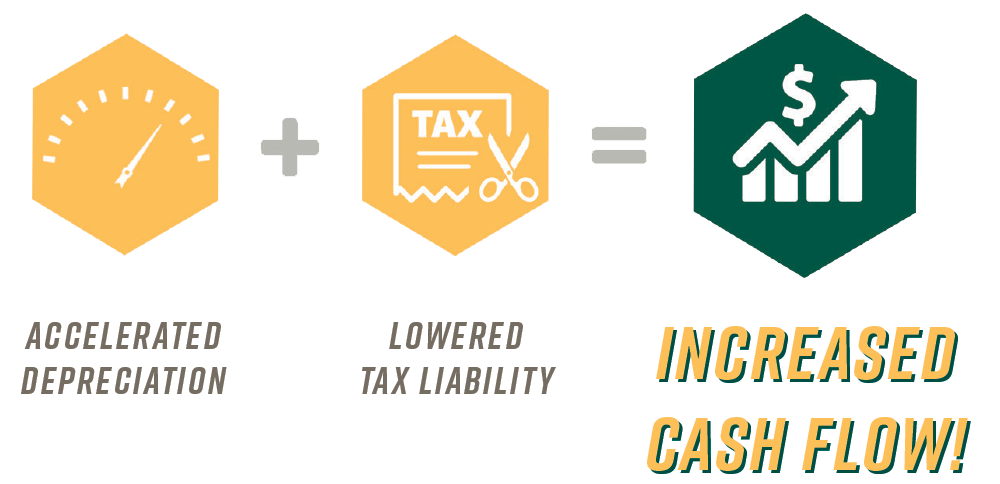

A Cost Segregation Study (CSS) is an engineering based report of the costs pertaining to a real estate improvement. The purpose of a CSS is to take advantage of accelerated depreciation tax deductions which provide immediate cash savings through a lower tax liability. This detailed report will allow the property owner to allocate an average of 20-40% of the property’s improvement value to asset classes with accelerated depreciation.

Generally, commercial buildings must be depreciated over 39 years and residential buildings over 27.5 years. With a CSS, owners have the ability to reclass a portion of asset costs to the following year classes: 5 years, 15 years, 17 years or 20 years, allowing an owner to reap depreciation benefits much quicker than the standard timeframe.

How It’s Performed:

Our construction and tax specialists evaluate a property to determine how much of the overall asset qualifies as real property (27.5 or 39 years) or personal property (5-20 years). Detailed records such as construction drawings or appraisals are reviewed, and site visits and interviews will be conducted. Our professional staff includes a licensed CPA, Registered Architect and various real estate and construction team professionals adept at cost engineering.

Qualifying Properties:

- New Construction

- Renovation Projects

- Leasehold / Tenant Improvements

What We Provide:

- Classification or reclassification of approprimate building components into the fitting tax life as allowed by IRS guidelines.

- Allocation of indirect costs to each asset.

- A written report with asset details supporting reclassifications.

Why Use J&S:

J&S Professional Services’ Team is comprised of CPA, Architecture and construction trade professionals that can collectively conduct a thorough and authoritative review of a building owner’s asset to determine how each building’s components should be reclassified in accordance with the IRS’ 13 principal elements to provide maximum tax benefits.

Email costseg@jsconstruction.com for questions or inquiries, or call 931-528-7475.